The challenge

Legacy core banking platforms inhibit banks from rapidly responding to market trends and providing personalised, actionable insights to customers due to their inability to easily access real-time customer and financial data.

The solution

Vault Core’s Universal Product Engine coupled with Moneythor’s unique solution delivers personalised, data-driven money management insights to banks and their customers in real time. This gives banks the chance to anticipate and respond to their customers’ continuously evolving financial needs while driving more personalised engagement and stickiness within their digital services.

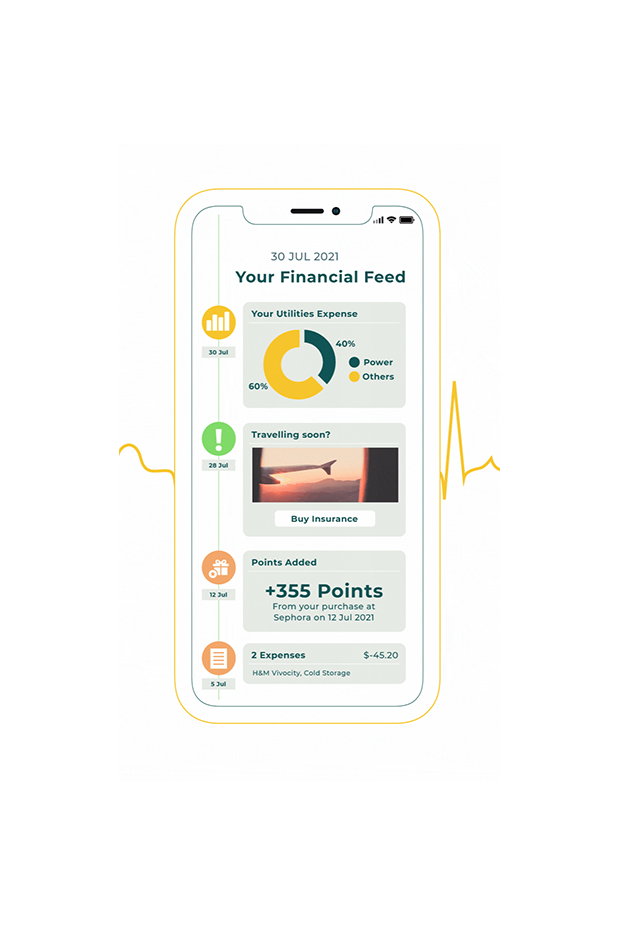

Utilising Vault Core’s real-time data feed, banks can provide personalised recommendations and nudges to their customers, along with categorised spending details, financial management advice, and goal setting functionality, whenever and wherever.

Real-time data analytics

Moneythor’s real-time data analytics capabilities powered by Vault Core enables banks to provide their customers with timely notifications (e.g. low balance, payment reminders) for better money management.

Actionable insights

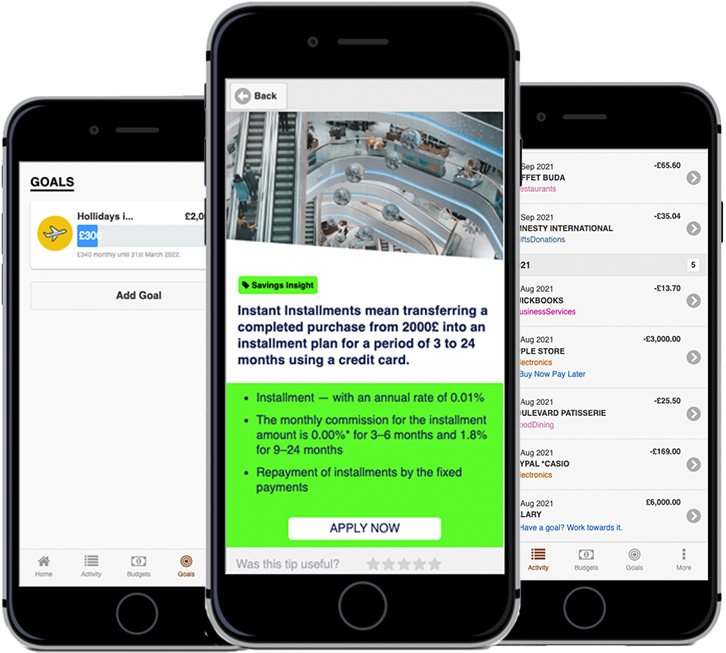

With access to Moneythor's insights and analytics platform, banks can serve as customers’ trusted advisors by providing contextual and actionable recommendations, such as saving for short or long-term financial goals.

Generate customer upsell opportunities

With the increased customer insights, banks can make timely recommendations of new products to customers at moments that matter and fully leverage Vault’s smart contracts to create hyper personalised customer journeys

Transactions from Vault Core are streamed, transformed, and pushed into Moneythor in real-time, using Kafka. A bank has the option to connect its customer-facing app to Moneythor’s front-end API to offer its customers a tailored, contextual and actionable user experience.

The integration exclusively loads data from Vault Core into Moneythor by leveraging Kafka at both ends, rather than with API calls. All relevant events from Vault Core are translated into Moneythor payloads and are pushed into Moneythor on a Kafka topic.