The challenge

Consumer and institutional demand for digital assets has exploded in recent years, yet banks have struggled to provide their customers access to this market. Offering buy, sell, and hold capabilities for digital assets used to be highly complex, fraught with risks, and technically challenging given the limitations with legacy applications.

The solution

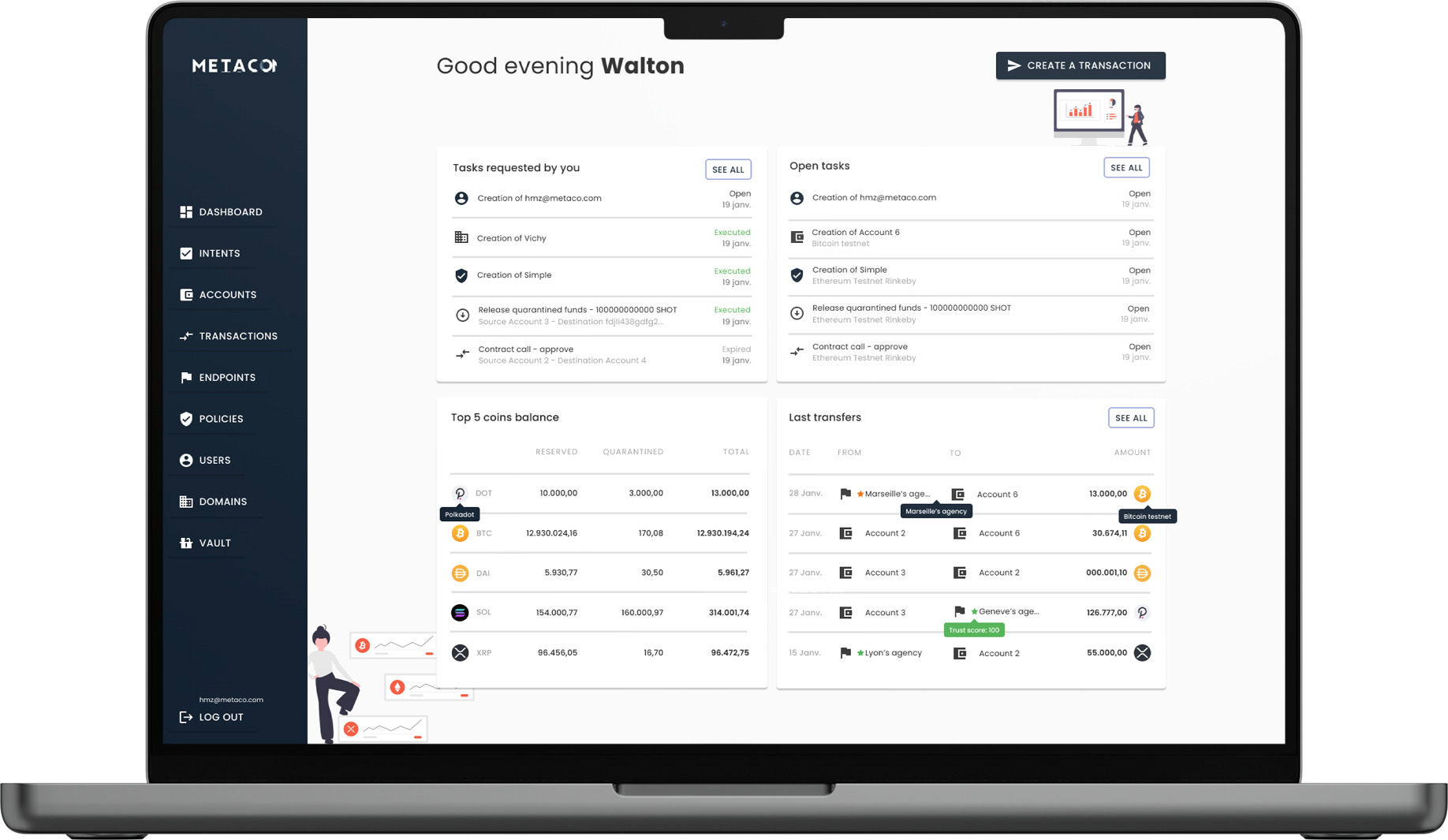

Using Vault Core’s real-time capabilities and Metaco’s Harmonize platform, banks can now unlock new asset classes, such as crypto currencies and tokenized securities, for their customers in a secure, compliant and seamless manner that integrates directly into an existing current account.

-01.png)

A single core banking platform for both non-fiat and fiat balances

As the adoption and usage of digital assets increases, banks will be required to offer a crypto trading capability by their customers. Our core banking engine, Vault Core is perfectly positioned to help support this need, as it stores both fiat and non-fiat balances in the same core platform. Vault Core’s integration to Metaco’s digital asset orchestration platform, expands access into stable-coin payments, token issuance, NFTs, treasury, DeFi yield generation and more, offering a seamless customer experience across the entire value chain.

Fast go-to-market with highest security and compliance

Banks can either start from scratch or migrate their existing private keys off-chain to Vault Core, unlocking Tier 1 bank grade security, with no single point of compromise, scalable compliance across multiple jurisdictions and leveraging the broadest connectivity to all major crypto and digital asset exchanges, brokers, market makers, as well as public / private ledgers.

Potential for revenue generation

Our integration with Metaco enables banks to connect to one or more cryptocurrency exchanges and execute transactions on multiple currencies backed by blockchain technology. Creating a unified banking experience, which enables the buying and selling of digital assets alongside traditional accounts, in this way gives banks the potential to create new revenue streams by charging a margin for the provision of this service.

The integration between Metaco and Vault Core allows banks to track cryptocurrency owned by the bank and its customers, stored securely by Metaco. It does this by producing a live balance of the cryptocurrency within Vault Core which can then be used to transact between accounts. It also exposes a REST API which allows the bank to send cryptocurrency out of Metaco to an external user.

The integration has been built around an ‘omnibus model’ where a small number of accounts are configured on the digital asset management (DAM) service to support the bank’s cryptocurrency transactions. This model is typically adopted by retail banks resulting in a higher volume of off-chain transactions, which can be executed more quickly than on-chain transactions.