The challenge

Due to the rise in digital adoption, there has been a significant increase in the number of criminals laundering money to disguise their illegal activities and make their funds look legitimate. Banks are expected to offer seamless customer experiences while also stopping fraud in its tracks.

Banks need to be able to balance these goals and manage risk effectively in the digital banking era while also staying ahead of anti-money-laundering trends.

The solution

Our integration with Feedzai directly addresses this challenge by allowing a bank running Vault Core to run all transactions generated by their customer through the Feedzai Financial Crime platform. This enables a bank to run both off-line and real-time anti-money laundering and sanction checks for their customers’ transactions.

Increased control

Integrating Vault Core and the Feedzai Pulse platform gives banks full control over their risk strategy. Banks can pre-define lists of high-risk merchants to prevent unwanted activity and spot aggregated spending with such high-risk merchants.

Improved understanding of customer activity

Our integration with Feedzai gives banks real-time visibility over customer spending. Banks are able to easily spot significant changes from previous average activity, rapid movement of funds, activity in dormant accounts as well as significantly large transactions.

Risk thresholds tailored to individual customers

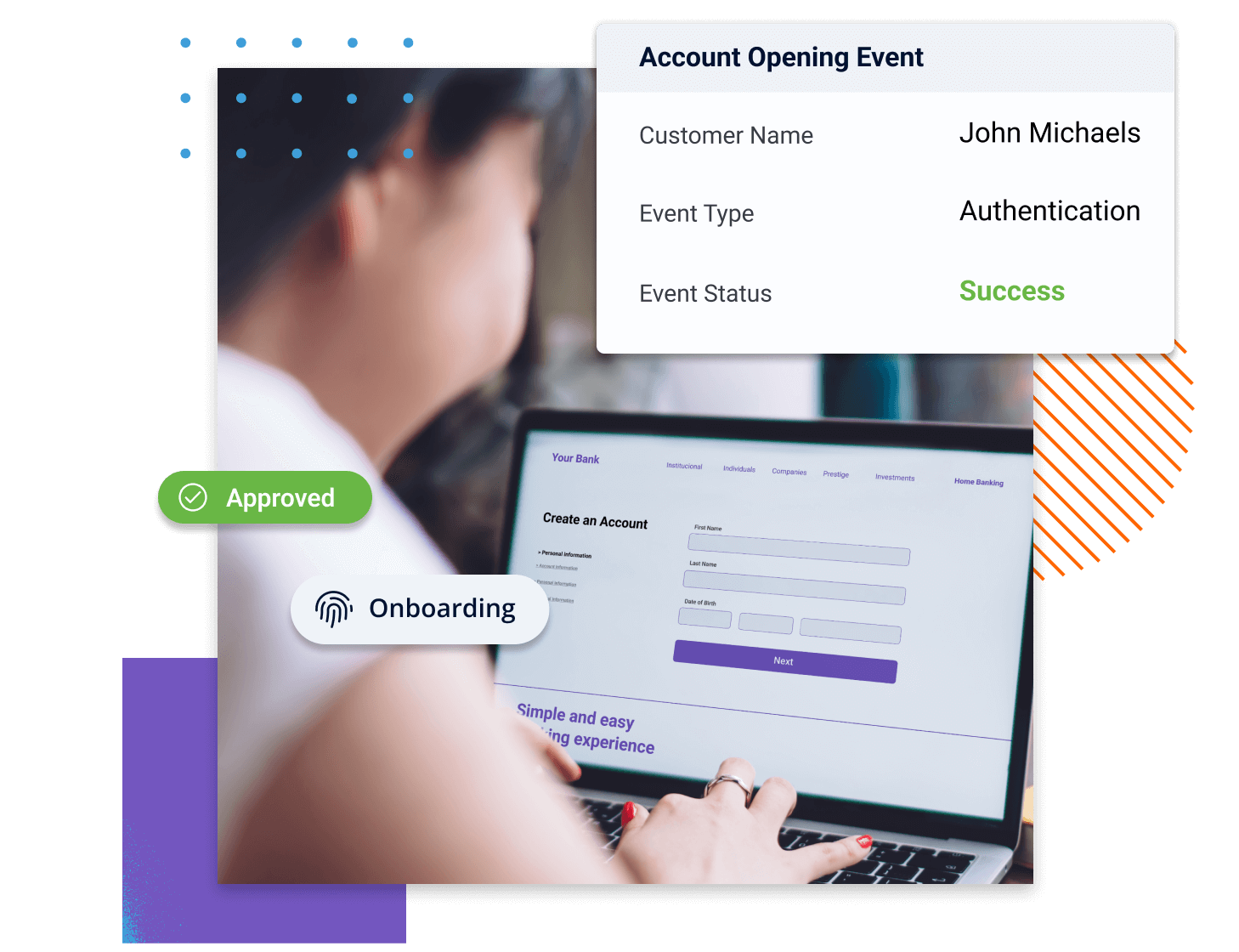

Our integration with Feedzai enables banks to set reporting thresholds at the time of customer onboarding. This allows banks to set risk thresholds at the customer level based on the result of risk assessments and customer due diligence checks at the point of onboarding. Designing risk thresholds at the customer level allows banks to tailor and monitor customer activity based on each customer’s individual profile which drastically reduces false positives.

This integration operates by listening to public Kafka topics from Vault Core. When a relevant Feedzai message appears, the message is translated into a Feedzai compatible format. This is then posted via Feedzai’s REST API into Pulse.